Can You Get a Mortgage with a 630 Credit Score in 2024?

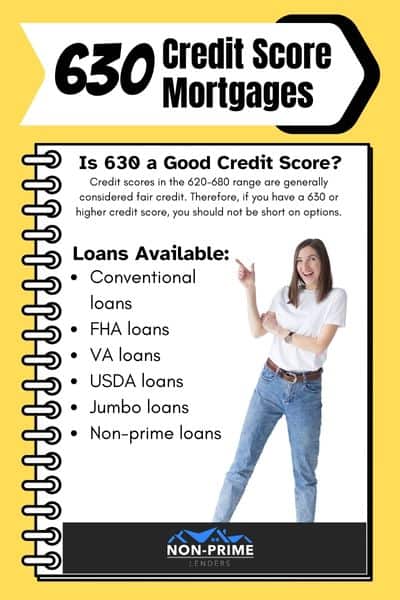

If your credit score is a 630 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s. Therefore, if you have a 630 or higher credit score, you should not be short on options.

The types of programs that are available to borrowers with a 630 credit score are: conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, and non-prime loans. With a 630 score, you may potentially be eligible for several different types of mortgage programs.

Conventional Loan with 630 Credit Score

The minimum credit score requirement to get a conventional loan is 630. In order to qualify for a conventional loan, you will need to meet all other loan requirements. This includes having at least 2 years of steady employment, a down payment of at least 3-5%, and no recent major credit events (such as a bankruptcy or foreclosure).

Would you like to find out if you qualify for a conventional loan? We can help match you with a mortgage lender that offers conventional loans in your location.

Click here to get matched with a mortgage lender

FHA Loan with 630 Credit Score

FHA loans only require that you have a 580 credit score, so with a 630 FICO, you can definitely meet the credit score requirements. With a 630 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% (unless you have satisfactory “compensating factors”, such as a higher down payment, or cash reserves).

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Click here to find out if you qualify for an FHA loan.

USDA Loan with 630 Credit Score

The minimum credit score requirements for USDA loans is now a 640 for an automated approval. Fortunately, you can still get approved for a USDA loan with a 630 credit score, but it will require a manual approval by an underwriter. In order to get approved with a 630 credit score, expect to have strong “compensating factors”, such as conservative use of credit, 2 months mortgage payments in cash reserves (savings), a low debt-to-income ratio, and/or long job history.

Other requirements for USDA loans are that you purchase a property in an eligible area. USDA loans are only available in rural areas, as well as on the outer areas of major cities. You can not get a USDA loan in cities or larger towns.

You also will need to show 2 years of consistent employment, and provide the necessary income documentation (2 years tax returns, and 2 recent pay stubs).

Click here to find out if you qualify for a USDA loan

630 Credit Score Mortgage Lenders in 2024

Below is a list of some of the best mortgage lenders for borrowers that have a 630 credit score. All of the following lenders offer conventional and FHA loans, and can help you determine what options might be available to you. If you would like some assistance finding a lender, we can help match you with a lender that offers loan options to borrowers with a 630 credit score. To get matched with a mortgage lender, please fill out this form.

3.) Guaranteed Rate

4.) Supreme Lending

6.) US Bank

7.) Flagstar Bank

8.) American Financial Network

9.) Freedom Mortgage

10.) Loan Depot

The lenders featured above all offer mortgage loans to borrowers with a 630 credit score. If you would like some help finding a lender, we can match you with a lender that offers home loans in your location.

Click here to get matched with a mortgage lender

Is 630 a Good Credit Score?

From a lending perspective 630 is considered to be a “fair” credit score. You can still get approved for virtually any type of mortgage if you are working with the right lender. However, the rate you are offered may not be as low versus what you may get with a much higher credit score.

If your credit score is 630 we suggest you allow us to help with your mortgage while you simultaneously work on improving your scores so you can get the best rate possible.

Can I Buy a House with a 630 Credit Score?

You can absolutely buy a house with a 630 credit score if you are speaking with a lender who is willing to accept 630. With a 630 score, you can potentially qualify for a conventional, FHA, VA, USDA and even a subprime loan.

How Much Can I Borrow with a 630 Credit Score?

The mount you are able to borrow is not tied to your credit score. With a 630 credit score, you should have the ability to borrow virtually any amount that you need. You will be limited based upon your income, debt to income ratio, down payment, and lender loan limits.

Frequently Asked Questions

Can I get a jumbo loan with a 630 credit score?

The minimum credit score required to get a jumbo loan depends on the lender. Most jumbo lenders require a borrower to have a credit score of at least 720. However, there are several non-prime lenders that offers jumbo loans to borrowers with credit scores as low as 600.

Can I get a VA loan with a 630 credit score?

If you are eligible for a VA loan (which are exclusively for veterans), you may be able to qualify with a 630 credit score.

What if I have had a major credit issue in recent years?

If you have had a bankruptcy, foreclosure, or short sale, there are several non-prime lenders that offer home loans to borrowers even just 1 day after such events.

What do non-prime loans offer?

Non-prime loans provide an opportunity to get a mortgage for borrowers that do not qualify for conventional and FHA loans. They have much less strict credit requirements, including no waiting periods after bankruptcies, foreclosures, and short sales. Non-prime loans also are available to borrowers with credit scores as low as 500 (or even below 500).

Are there other credit requirements that I should know about?

Most mortgage lenders require that you have 3 trade-lines on your credit report. This can be auto loans, credit cards, personal loans, or other qualifying lines of credit. There can be exceptions to this rule, including alternative bills that are often allowed (phone bills, utilities, etc.).

What are the interest rates for a borrower with a 630 credit score?

The interest rate will depend on your individual qualifications, the mortgage lender, and the date you lock your interest rate. We can help connect you with a mortgage lender that offers free rate quotes. To have a mortgage lender contact you, please fill out this form.

Is down payment assistance available to someone with a 630 credit score?

Yes, in fact many down payment assistance programs are available to borrowers with a 630 credit score. The types of programs that exist include both local (city, county, or state level), and nationwide programs. A mortgage lender can help you see if you qualify for down payment assistance. If you have lower income, you are even more likely to qualify, as these programs are often intended for lower income households.