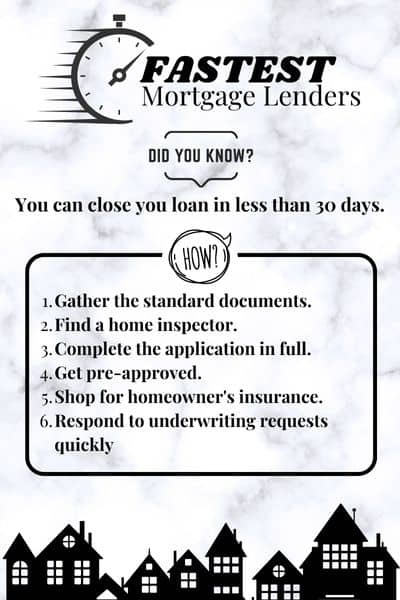

Fastest Mortgage Lenders

Purchasing a home within a tight timeline can be very stressful for new home buyers. Finding the fastest mortgage lenders can help to shorten the time it takes to close, but there are also things you can do as the home buyer to help reduce the time it takes to close the loan.

If you are purchasing a home, the closing time may be longer than if you are refinancing. We will discuss both down below and how you can prepare for closing quickly.

Prepare Yourself For a Fast Closing

You may be looking for lenders who can close fast, but the truth is that you play a significant role in how quickly your loan can close. It is understandable that most home buyers are not aware of the process, but if you take the steps below, you can help close your loan in less than 30 days.

Gather The Standard Documents

Prior to speaking with a lender, you should begin to put the basic required documents together. Do not wait until the lender asks for the information because it may take you a while to find everything that is needed. These are the documents the lender will ask for when you complete your loan application.

- Last 30 days pay stubs

- Last 2 months bank statements

- Last 2 years W2s

- Last 2 years tax returns

- Copy of your purchase contract

- Copy of your mortgage statement if you are refinancing

- Copy of you divorce decree if applicable

You should get electronic copies together and do not attempt to mail hard copies. This will save a few days. For some people, collecting the documents in advance process can save anywhere from 1-5 days.

Find a Home Inspector

Before contacting a lender, it may be smart to search for a reputable home inspector. Real estate agents often had a list of inspectors they could recommend. When interviewing the inspector, ask what their lead time is and get a commitment to have the inspection done within 24 hours, but then the report returned immediately after if possible.

Complete the Application In Full

When you find the lender that you want to work with, complete their online application immediately. It is important that you fully complete the application. If you leave out anything, it will absolutely delay the process because the loan officer cannot submit your application to underwriting until it is 100% complete.

Get Pre-Approved

Some lenders will provide you with a simple pre-qualification letter that you can present to your real estate agent. However, this does not mean you are approved.

You need your application to get approved by the underwriting department to secure a pre-approval. This is often just an automated underwriting approval that is done by a computer.

If you have low credit scores, a recent bankruptcy, high DTI, or some other issue then your file may need to be manually underwritten. This can take a little time which is why you want to get a real pre-approval as quickly as possible.

Shop for Homeowner’s Insurance

One of the conditions of your loan is for the home to have a homeowner’s insurance policy in place before closing. The lender will ask for a paid receipt for the first year and a copy of the declaration page.

If you do not have an insurance agent yet, then you should find one now to avoid delay the day the lender asks for your insurance information.

Respond to Underwriting Requests Quickly

You have already provided the standard documents, but once your application goes to underwriting, there will almost always be requests for additional documentation or information. If is imperative that you respond the same day with whatever they need. Your application is now on pause until you give the underwriting department what they need.

Some borrowers believe they should not have to provide what is being asked. Arguing over these requests will not help and it will only delay the mortgage process. If you do your best to comply with the underwriting requests, you can save quite a bit of time.

Fastest Mortgage Lenders for Primary Residences

The following lenders have been known to have shorter closing times. Each of these lenders specialize in different types of mortgages. We recommend that you complete this short loan scenario form and we will help guide you to the fastest mortgage lenders for your specific situation and location.

Streamline Refinances That Can Close Fast

If you currently have an FHA or a VA loan and you are looking to refinance, the streamline version of those programs can be closed quickly. You do not need to get an appraisal and there are very few documents needed. However, you cannot cash out equity with the streamline refinance.

The lender will not order an appraisal, no income documentation and it will not matter what your credit score is. The only requirement is that you have made on time mortgage payments for the past 12 months.

Fastest Mortgage Lenders for Investment Properties

If you are buying or refinancing an investment property, you may have options from lenders who can close in just a few weeks or less.

Private Money Lenders – Private money lenders are often able to close the fastest of any type of lender. A private money lender can be a friend or private money lenders who offer loans to individuals who want to purchase or refinance an investment property quickly. Read more about Private Money Lenders.

Hard Money Lenders – Hard money lenders offer short term loans for investment property financing. These lenders typically have the highest rates in the industry, but they are also the most flexible and easiest to get approved for.

There are other options when it comes to investment property financing including DSCR loans which are the most popular. However, these are the two types of investment property loans that can be closed the fastest.

What is the Fastest You Can Get a Mortgage?

The fastest you can get a mortgage is one week from a hard money or private money lender. Most traditional mortgages for primary residences can be closed in less than 30 days if you follow the steps outlined above.

What is the Easiest Type of Mortgage You can Get Approved For?

The easiest type of mortgage to get approved for is a stated income loan where you qualify only based upon your credit score and down payment.

Can You Close on a House in Two Weeks?

You can close on a house in two weeks if you have your application completed and submitted to underwriting, all of the documents submitted, and appraisal ordered.