Home Loans for Teachers

Are you a teacher looking to purchase a home or refinance your existing mortgage? Perhaps you have less than perfect credit, and need a mortgage with lenient qualification requirements? There are various home loans for teachers which may include down payment assistance, bad credit or recent bankruptcies.

Teachers comprise a significant amount of the American workforce, with nearly 3.2 million accounted for in 2024. Fortunately, there are more home loan products, and down payment assistance programs available for teachers, than there are probably any other profession.

Many teachers want to know which mortgage program will offer them the best loan terms. We encourage you to take the time to review each type of loan on this page, and see which may be best suited for you in every state within the US.

Introduction to Home Loans for Teachers

Home loans for teachers are specialized mortgage options designed to assist educators in purchasing a property. The benefits for these mortgages often include lower interest rates and flexible eligibility criteria tailored to the needs of teachers.

Some educator programs for teachers provide down payment assistance or grant options. We also have the ability to provide down payment assistance for teachers who meet the minimum credit score criteria.

Teachers can qualify with assistance for conventional, FHA, VA and USDA loans.

Benefits of Mortgages for Teachers

Some of the many benefits teachers have when looking for mortgage options includes the following:

- Third party grants and down payment assistance may be used

- Assistance may be offered for teachers who meet the minimum credit score requirements

- Competitive interest rates

- Closing costs may be covered by your lender in exchange for a rate adjustment

- Approvals for relocation to another state available with a written job offer

- Recent job changes can be accepted without a two year waiting period

Teacher Mortgage Programs – Home Loans for Educators

Teachers have a wide range of home loan options available to them. This includes traditional mortgages, such as conventional and FHA loans, as well as some special loan products. The rest of the article will outline the loans for teachers to buy a house:

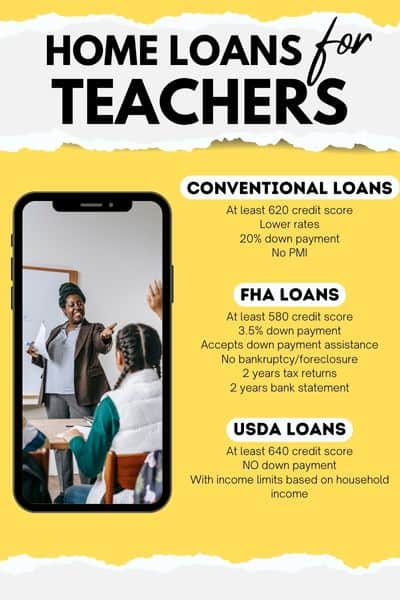

Conventional Loans for Teachers

Teachers with good credit (at least a 620 credit score) should first see if they qualify for a conventional mortgage. Conventional loans usually will offer the competitive loan terms, such as lower interest rates. They are also best for teachers who can put a down payment of 20% or more on their home purchase. If you put 20% down on your home purchase, you will not be required to pay PMI (private mortgage insurance).

We recommend that you see if you qualify for a conventional loan with us first. If you are unable to get approved for a conventional mortgage, your loan representative will help you determine what other types of mortgages you may qualify for based upon your needs.

Click here to find out if you qualify for a conventional loan

FHA Loans for Teachers

FHA loans are a great option for teachers that do not have good or excellent credit. They are also an ideal option for teachers that are looking for a low down payment. With a 580 credit score, you may qualify for a 3.5% down payment, and down payment assistance may also be used.

If you have credit scores below 580, then you can still get approved with a 10% down payment.

A common misconception is that FHA loans are only for first time home buyers. They are certainly a good option for many first time buyers, but they are not exclusively available to them.

In order to qualify for an FHA loan, you will need at least a 500 credit score, but most lenders want to see a 580 or higher FICO score. There are also other guidelines related to your credit, such as no recent bankruptcies or foreclosures. You must also be able to provide your last 2 years tax returns, W2’s, and 2 most recent bank statements.

Click here to learn more about FHA home loans

USDA Loans for Teachers

Teachers looking to purchase a home with no down payment should take a look at USDA loans. The USDA rural development loan offers a home buying program with no down payment, and you only need a 600 credit score to qualify. Keep in mind that these loans are only available in rural areas, as well as zones just outside of cities and towns.

There are also strict income limits in place, which for most teachers, their income should fall within these limits. However, if you have a spouse that makes a large income, this could disqualify you. The income limits are based on the average household income in your county. You can look up the income limits for your county here.

Click here to learn more about USDA loans

Loans for Teachers with Bad Credit

With very low credit scores, your best option will be an FHA loan. If your credit scores are under 580, the down payment requirement will be 10%. This can absolutely be a reality for you and we have a few lenders who can work with those credit scores.

If you do not qualify for an FHA loan, there are other home loans that you may be eligible for. This includes non-prime programs that allow credit scores all the way down to 500! All of these loan programs will require a larger down payment of up to 25%

Another major advantage of some of the non-prime programs is that they do not have any waiting periods for major credit issues, such as bankruptcies, foreclosures, and short sales. With these loan programs, you may be able to get a mortgage even just 1 day after such events.

If your credit is below a 580, and you are interested in seeing if you qualify for a non-prime mortgage, we recommend contacting us. Based on your personal credit and income situation, we can help find the best program for you.

Click here to learn more about bad credit mortgages

Eligibility and How Teachers Can Get Approved for a Mortgage

The criteria and eligibility requirements below apply to the majority of the loan programs available for teachers. This information on how to secure an approval is your first step in home ownership.

- The home must be your primary residence. We have programs for second homes and investment properties, but the assistance programs would not apply.

- Teachers are required to fully document their income.

- You will need to provide 2 years of tax returns and W2s

- The last two months of your bank statements and retirement or investment accounts will be requested

- You will need an appraisal for both purchases and refinances

- Verification or employment is required

These are just some of the basic requirements. Each application and situation is going to be different and therefor additional requirements may apply.

Some tips on how to get approved or to secure the best rate are as follows:

- Maintain a good credit history and high credit scores.

- Avoid filing for bankruptcy prior to applying for a mortgage.

- Do not make any large purchase such as buying a new car in the months leading up to completing a mortgage application.

- Do not take too much time off in between jobs.

We hope this information will help you to get prepared to purchase a home. We encourage you to contact us so we can answer any questions you may have.

Good Neighbor Next Door – Discount Homes for Teachers

The Good Neighbor Next Door program is a special home buying opportunity for teachers, firefighters, police officers, and emergency medical technicians. This program offers a 50% discount on select HUD homes.

How this program works is upon finding an eligible home (which we can assist you with), you will be placed in a lottery with other applicants interested in the same home. If there are no other applicants, you can purchase the home (if you qualify). If there are 3 total applicants, you will have a 33.3% (1/3) chance of winning.

In order to obtain the home, you must use an FHA loan. A huge benefit of this program, is the down payment is only $100! That means you could get a home for half the cost, and with only $100 out of pocket!

This program is a little complex, so we recommend having a loan representative answer your questions. If you want to learn more about this program, contact us.

Down Payment Assistance for Teachers

There are many down payment assistance programs available to teachers. This includes general programs offered to people of many occupations, as well as a few unique grants that are exclusively available to teachers (and other civil servants, such as police officers and firefighters).

In fact, there are so many different down payment assistance programs that we feel there are too many to list. This is especially the case since many offered locally at the state, county, or city level. If you want to find out what down payment assistance programs you may qualify for, fill out this form.

Teacher Refinance Mortgage

Teachers have the opportunity to refinance their mortgages to lower the rate, change the term, or cash out equity. There are no assistance programs when it comes to refinancing, but there are various mortgages available for teachers.

Refinancing to lower the rate or the payment is what most teachers ask us to do. The mortgage program you select will be highly dependent upon how much equity you have in the home and also your credit score. Once you hear all of your options, you can make the best decision for your scenario.

If you are looking to cash out equity, you can refinance with an FHA loan up to 80% of your appraised value. If you need more than 80%, we can provide you with a quote for a conventional loan with PMI.

Mortgages for Teachers with a Recent Bankruptcy

If you have a recent bankruptcy, you can still get approved for a mortgage as a teacher. The requirements and type of loan you can apply for will vary based upon the type of bankruptcy and how long ago it was discharged.

Chapter 7 Bankruptcy

If you had a recent Chapter 7 bankruptcy, you can qualify for a subprime mortgage just one day after the discharge date. Once you are at the two year mark, you can qualify for an FHA loan.

Chapter 13 Bankruptcy

If you had a recent Chapter 13 bankruptcy, we can help you to get approved for an FHA loan after just 12 months of bankruptcy payments and before the discharge date.

Frequently Asked Questions About Teacher Home Loans

What mortgage lenders offer home loans to teachers?

You can apply for a mortgage with just about any mortgage lender. We can help you because we specialize in providing home loans for teachers.

The benefit is we have a great deal of experience working with various programs available to teachers, such as the HUD Good Neighbor Next Door program, and down payment assistance programs for teachers.

If you would like to speak with someone, contact us today.

Are there any special home loans for teachers?

Mortgage lenders are not allowed to offer special home loans to borrowers based on their profession. The only exception is the HUD Good Neighbor Next Door program, which offers discounted homes to teachers.

There are also mortgage lenders that specialize in helping teachers by offering assistance programs for teachers specifically that can be used with any mortgage.

What locations are these mortgage programs available in?

For any mortgage solution that you are looking for, we can help you in all 50 states. Just complete this short form and someone will contact you without pulling credit.

Are there any specific loan programs or incentives for teachers?

There are incentives available for teachers who can meet the minimum qualifications and requirements.

Can I get a home loan with bad credit as a teacher?

Teachers can get a mortgage with bad credit with scores as low as 500.

Are there any down payment assistance programs for teachers?

There are down payment assistance programs for teachers either through local organizations, or through a lender who can include the down payment assistance as part of their program. Contact us for more details.

Can retired teachers qualify for home loans?

Retired teachers can qualify for a home loan using their retirement income and social security benefits.

How long does it take to get approved for a home loan as a teacher?

Teachers can secure an initial approval for a mortgage in less than 24 hours.

How much down payment is required for a home loan for teachers?

Teachers can apply for a mortgage with as little as 0-3.5% down depending upon the mortgage program.

What is the maximum loan amount available for teachers?

The maximum loan amount available for teachers is the lesser of their approval amount, or the loan limit for the mortgage program they are applying for.

What kind of properties can be purchased using a home loan for teachers?

Teachers can purchase a single family home, 2-4 unit properties, mobile home, condo, or townhome.

Statistics Related to Teacher Loans