Are you looking to purchase a home in California, but do not have a social security number? An ITIN mortgage loan may be the perfect solution for your to finance a home purchase. If you have an ITIN number (individual taxpayer identification number), you may qualify for one of these loan programs.

Click to Speak with a Bilingual Loan Officer

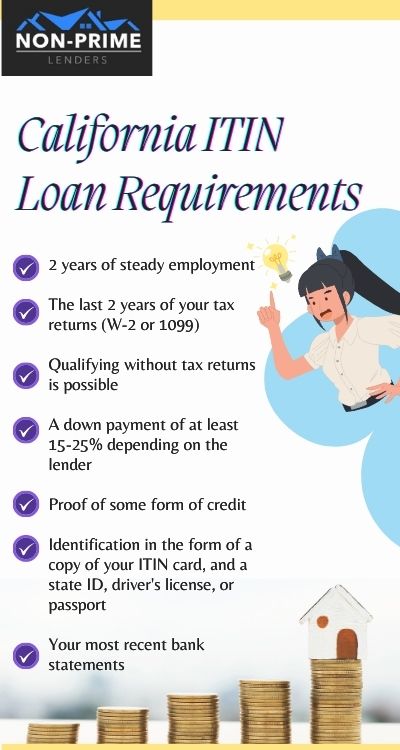

California ITIN Loan Requirements

In order to qualify for an ITIN loan in California, you will need to satisfy the lenders requirements. Most lenders offering these programs will require the following:

- 2 years of steady employment.

- The last 2 years of your tax returns (W-2 or 1099).

- Qualifying without tax returns is possible if you are self employed

- A down payment of at least 15-20% depending on the lender.

- Proof of some form of credit. A standard credit report is usually not required, but they may want to see you provide proof of paying bills such as those for home utilities and cell phones.

- Identification in the form of a copy of your ITIN card, and a state ID, drivers license, or passport.

- Your most recent bank statements (some lenders will want to see the last 2 months, but others may require up to 6 months).

Click to Get a Quote for an ITIN Loan From a Spanish Speaking Loan Officer

Best California ITIN Mortgage Lenders

Below are some of the top ITIN mortgage lenders in California. These are just a few options and we recommend contacting us to find out who has the lowest down payment, and also which lender is most competitive at this moment. Contact us to get matched with an ITIN Lender who Speaks Spanish

1 – Dream Home Financing – contact

2 – Prime 1 Bancorp – contact

3 – First National Bank of America – contact

4 – Go Alterra – contact

5 – ACC Mortgage – contact

6 – United Mortgage Corporation – contact

Would you like some help finding an ITIN lender? We can help match you with a mortgage lender that offers ITIN loans in California. Let us know if you need a bilingual Spanish speaking loan officer.

Click here to get matched with an ITIN lender

ITIN Loan to Purchase a Home in California

You can purchase a home in California with an ITIN number for your primary residence, a second home, or an investment property. The following property types are acceptable:

- Single family homes

- 2-4 unit properties

- Condominiums

- Townhouses

- Mobile homes

The down payment with an ITIN number will be a minimum of 15-20% in California and the credit score minimum is 600

ITIN Loan to Refinance in California

Refinancing your home with an ITIN loan is also possible. If you are trying to cash out equity, you will be capped at 70% of the appraised value of your home.

Document Requirements for California ITIN Mortgage Loan Applications

When applying for an ITIN mortgage loan, you will need to gather the necessary documents to support your application. These documents typically include:

- Proof of identification: Provide a valid and unexpired passport or national identification card.

- Proof of income: Submit recent pay stubs, tax returns, W9’s, or other documentation that verifies your income and employment status.

- Proof of residency: Show evidence of your current address, by providing an ID or documentation from a lease agreement or utility bill.

- Bank statements: Provide statements from your bank accounts to demonstrate your financial stability.

- Credit history: Obtain a copy of your credit report to assess your creditworthiness.

- Additional documentation: Depending on the lender’s requirements, you may need to provide additional documents, such as proof of assets or a letter of explanation for any irregularities.

Step-by-Step Guide to Applying for an ITIN Mortgage Loan in California

Follow these steps to apply for an ITIN mortgage loan:

- Research lenders: Find lenders that offer ITIN mortgage loans and compare their terms and requirements.

- Gather documents: Collect all the necessary documentation to support your application.

- Pre-qualification: Get pre-qualified by the lender to determine the approximate loan amount you may be eligible for.

- Complete the application: Fill out the application form provided by the lender, ensuring all information is accurate and complete.

- Submit documentation: Attach all the required documents with the application form.

- Review and approval process: The lender will review your application and documentation, conduct a credit check, and assess your eligibility.

- Underwriting and appraisal: If your application is approved, the lender will perform a residential appraisal of the property and complete the underwriting process.

- Loan commitment: Upon successful underwriting, you will receive a loan commitment in the form of a letter outlining the terms and conditions of the loan.

- Closing: Schedule and attend the closing. This is where you will sign the ITIN loan documents and pay any applicable fees.

ITIN Down Payment Assistance

Down payment assistance may be possible with an ITIN number. Keep in mind the lenders do not offer this assistance. You will need to find a down payment assistance program in California that offers their program to individuals with an ITIN.

Lenders will accept that down payment assistance as a source of funds for your down payment if you are able to find it.

Down payment gifts from a relative are acceptable with an ITIN loan. The person gifting you the down payment will need to write a gift letter indicating the money does not need to be repaid.

Frequently Asked Questions

Can I buy a house with an ITIN number in California?

You can buy a house with an ITIN number in California if you have good credit and at least 15% down.

What types of properties are eligible for these loans?

ITIN loans may be used on single family homes, condos, and PUDS.

Can an ITIN loan be used for an investment property?

No, ITIN loans only may be used for a home that is owner occupied (primary residence).

Are ITIN loans available through the FHA?

No, the FHA does not offer any ITIN programs.

Are there any laws against mortgages being issued to borrowers without a SSN?

There are no laws that exist that restrict mortgage loans being offered to non-citizens. It is just that most lending institutions have a preference to only offer loans to borrowers with a social security number. Additionally, neither Fannie Mae, Freddie Mac, or the FHA back these types of loans creating difficulties pertaining to the secondary mortgage market. Thus, only unique types of lenders, namely “portfolio lenders” offer these types of loans.

Helpful Reading

ITIN loans are most popular in California, Colorado, Illinois, Oregon, Texas, Michigan, and Washington state, but are available in all 50 states.