North Carolina FHA Lenders – FHA Loan Requirements NC

FHA loans are a good option for a variety of borrowers. This includes those who want to place a low down payment, as well as those that struggle with some credit issues. Some think of FHA loans as subprime mortgages, but they technically are not. However, they do serve borrowers that can not qualify for a prime mortgage or conventional loan.

North Carolina FHA lenders are able to help purchase or refinance your home and also provide the funds needed to rehab or update the home.

2024 North Carolina FHA Loan Requirements

You may view the primary FHA loan requirements for North Carolina below. Each individual FHA approved lender may have some of their own loan requirements in addition to these.

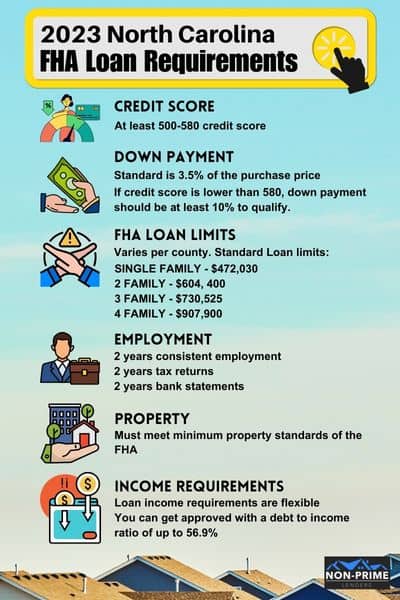

Credit – Most North Carolina FHA lenders will require that you have at least a 580 credit score. However, we work with a few lenders that will go down to a 500 credit score.

Down Payment – The standard down payment requirements for a FHA loan is 3.5% of the purchase price. So on a $200,000 loan, the down payment would need to be $7,000. If your credit score is below a 580, you may need to place as much as 10% down in order to qualify.

Loan Limits – You can view the 2024 FHA loan limits for North Carolina, here. This shows the maximum loan amount allowed by county in North Carolina. The amount you personally qualify for will largely depend on your income.

Employment – FHA loans require that you prove 2 years of consistent employment. You will need to provide at 2 years tax returns, and most lenders want to see your 2 most recent bank statements as well.

Property – The FHA has property requirements, which includes what are known as “minimum property standards”. The home you want to purchase must undergo an appraisal and meet these guidelines, which relate to the condition of the home. The appraisal must also verify the value of the property.

These are the standard requirements for a FHA loan. When you apply, if you are approved, you will be provided a checklist of requirements known as “loan conditions”, which will outline what you must provide in order for the loan to close.

Click here to see if you qualify for an FHA loan

Best FHA lenders in North Carolina

Below are some of our top picks for the best FHA lenders in North Carolina. Not every lender has the most flexible guidelines. As a result, we recommend that you contact us and we will help you to find the best option. Click to Speak with someone

1.) Quicken Loans

2.) Guaranteed Rate

3.) NC FHA Expert

Please note: We are not affiliated with all mortgage lenders that are featured on our website. We include who we consider to be the best lenders for various mortgage programs. If you would like some help getting connected with an excellent FHA lender in North Carolina, please fill out this form.

FHA Loan Income Requirements

The income requirements for FHA loans in North Carolina are very flexible. You can get approved with a debt to income ratio of up to 56.9% which is much higher than what conventional loans will allow.

Many people ask how much they need to make to get approved for an FHA loan, but there are so many factors that will help make that determination. Your credit scores will decide the interest rate which in turn will be linked to your income when calculating the DTI. If you plan to buy a home with high property taxes, then your income will need to be higher to make up for that.

The first thing you should do is have a conversation with a loan professional who can let you know what your estimated price range will be based upon your income. Click to have someone call you.

North Carolina FHA Loan Limits

Every year, HUD establishes the new FHA loan limits for every county in the United States. These loan limits are the maximum FHA loan amount allowed in that county. If you buy a home that costs more than the loan limit, then the difference will need to be paid as an additional down payment.

The standard loan limits for North Carolina in 2024 are as follows:

Single Family = $498,257

2 Family = $637,950

3 Family = $771,125

4 Family = $958,350

There are some counties in North Carolina that are considered to be high cost counties and the loan limits are higher. To see what the limits are in your county, visit our North Carolina loan limits page.

How to Get an FHA Loan in NC

Finding an FHA loan in North Carolina should not be too difficult because almost every lender offers the program. However, not every lender will offer an FHA loan for all circumstances.

For example, if you have poor credit, a high DTI, need a rehab loan, or have a recent bankruptcy then most lenders will not help unfortunately. We do have the ability to help with all of these situation and more.

The first thing to do is understand your credit and financial situation. Find out what your credit scores are and try to improve them if you can. Know what your down payment funds are and make sure that your job is stable. If you think you may be low on income, then ask someone close to you if they would be willing to co-sign.

When you are ready, complete this short loan scenario form and someone will contact you to see how much you can be approved for.

Bad Credit Home Loans NC

If you have bad credit, you may still qualify for a home loan in NC. The down payment will be 10% if your credit scores are below 580. While most lenders will not accept scores that low, we can help you to find a lender who is able to provide a pre-approval without having to improve your scores.

Keep in mind there may be other issues with your credit which could derail your approval. Having a recent chapter 7 bankruptcy or car repossessions will likely be challenging for a lender to overcome. If you have disputes, the lender may need you to remove those before they can continue with your application.

Frequently Asked Questions

Are FHA loans only for first time home buyers in North Carolina?

No, FHA loans are not restricted to first time home buyers. If you have owned a home before, you may still get a FHA loan. However, you may only have one FHA loan and they are only available for primary residences.

Is down payment assistance available for FHA loans?

Yes, if you qualify for down payment assistance, you can be used with a FHA loan. There are many programs available that provide funds to use for down payment assistance. We can help you find out if you qualify for any of them.

What are the options to refinance a FHA loan?

The FHA offers two different programs for refinancing a FHA loan. This includes the FHA streamline refinance, which allows you to easily lower your interest rate and mortgage payment (and does not require a credit check, income documentation, or a new appraisal). The other option for refinancing an existing FHA loan, is the FHA cash out refinance, which allows you to pull out money from the equity in your home.

Are cosigners allowed on FHA loans?

Yes, cosigners are allowed on FHA loans. At least one of the borrowers must occupy the property. Non-occupying co-borrowers are allowed though, which means the person cosigning does not need to live at the property that is financed using a FHA loan.

How long after a bankruptcy can you get a FHA loan?

The FHA rules state that you must wait at least 2 years after filing a chapter 7 bankruptcy. For a chapter 13, you only need to wait until you have successfully made 12 months of payments. Additionally, you will need to provide the court trustee’s written approval. Also, keep in mind that the clock doesn’t start upon filing, but rather once the bankruptcy has been discharged.

How long after a foreclosure can you get a FHA loan?

The FHA rules state that you must wait at least 3 years before you are eligible for a FHA loan. However, there is an exception to this rule if there were “extenuating circumstances”, such as a job loss. You would also have to show some improvements to your credit since the foreclosure. In the event that the circumstances and credit improvements are satisfactory, you would only have to wait until after 1 year before you can apply for a FHA loan.