Best Mortgage Lenders for the Self Employed in 2024

Are you self employed? Have you experienced any difficulties in obtaining a home loan due to your self employment? You may be happy to know that there are numerous mortgage lenders that offer helpful loan programs to self employed borrowers.

Eric Jeanette – “There are a variety of different types of self employed mortgage options available with and without the ability to provide tax returns.”

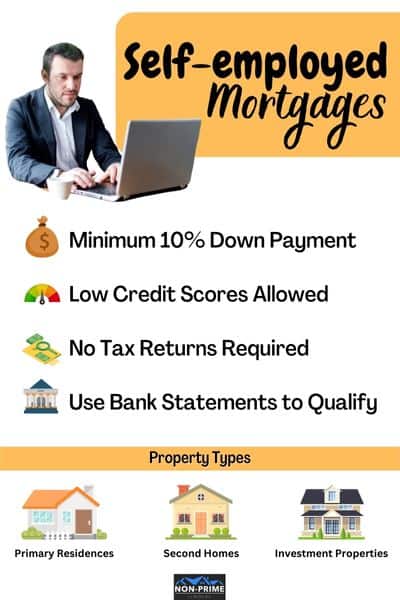

The most common mortgages are conventional and FHA loans. However, most self employed borrowers cannot qualify for those programs because of the legal write offs they take on their tax returns. Therefore, there are programs such as bank statement mortgage programs (which allow you to use your personal and/or business bank statements to verify income instead of tax returns).

If you can use your tax returns, you may qualify for a conventional or FHA loan and you can learn more about these loans below. For many business owners, contractors, and other types of self employed professionals, using tax returns may not always be an option. For these individuals, bank statement loans may be the best and quite possibly the only option to get a mortgage.

Do you have 1 year of tax returns, but not 2? You may be eligible for a 1 year tax return mortgage. These are all various options to help self employed borrowers to find the right mortgage for their purchase or refinance.

We have years of experience in helping each self employed customer to find a loan option that suits there needs. Let us help you through the home buying or refinancing process.

Best Mortgages for Self Employed or 1099 Employees

The best mortgage lenders for self employed business owners will have various programs depending upon whether you can use tax returns to prove your income, or if you need a no doc loan.

Most traditional banks with a well known reputation are not best suited for helping self employed borrowers. They will look at your net income after your write offs or deductions. The best mortgage lenders for self employed will offer bank statement loans, stated income loans, and other creative programs that do not require tax returns.

We will cover the following type of mortgages for self employed borrowers:

- Bank Statement Loans

- Stated Income Loans

- Conventional Loans

- FHA Loans

Bank Statement Loans for Self Employed

A bank statement loan is a creative mortgage program that does not focus on the income that you document on your tax returns but instead looks at your average monthly deposits into your bank accounts. It is more of financial analysis of your incoming revenue.

Mortgage providers for self employed will ask for 12-24 months of your bank statements and will look at the average monthly deposits. Then, depending upon the type of bank statement that you have (business or personal), they will use a percentage of that average as the monthly income on your tax returns.

The lender may also look at how much experience you have in the industry, the type of reputation your business has, its online presence,

You can expect the down payment to be anywhere from 10-25% and the interest rates will be higher than conventional loans. If you would like to know more, contact us to discuss.

Stated Income Loans for Self Employed

Stated income loans were extremely popular prior to 2008 but now there are a handful of lenders who offer the program. Just like the bank statement loan, you will not have to provide your tax returns. With the stated income loan, you also will not have to provide bank statements (read more).

Stated income loans require better credit scores and the down payment will be higher. Your lender may also require you to have payment reserve of 6-24 months. You can expect the interest rates to be slightly higher than FHA or conventional rates.

The program can be used to purchase a primary residence, second home, or investment property. However, for investment properties we recommend the DSCR loan.

If you would like to know more about stated income loans or to get a quote, contact us to discuss.

Conventional Loans for Self Employed Borrowers

There has been an increase in the availability of conventional financing for self employed borrowers.

Recently, Fannie Mae updated their guidelines for the self-employed. This includes the possibility of qualifying for a home loan with only 1 year of tax returns. There has also been other areas of the qualification guidelines which have become more lax, resulting in higher loan approval rates.

One of the primary areas that conventional lenders will look at is the reliability and stability of your income. If your income is deemed to be too inconsistent, or in a significant state of decline, you may be disqualified.

Your credit score still needs to be at a minimum of 620 to meet Fannie Mae eligibility guidelines.

FHA Loan Guidelines for Self-Employed Borrowers:

Many people assume that you must be a W-2 employee to be eligible for a FHA loan. This is not the case. In order for a self employed person to qualify for a FHA loan they just meet the following requirements:

- You must have been consistently self-employed in the same line of work for at least the last 2 years. This shows stability and provides financial confidence for the lender.

- The industry that you work in must be deemed to have a likelihood of continuing to offer profitable opportunities.

- Your income must be consistent, stable, and reliable. If it is in decline (20% or more from the previous year), this may cause your application to be rejected.

- It may be required that you submit a profit and loss statement (P&L).

- The minimum credit score for an FHA loan is 500.

The above FHA loan guidelines are unique characteristics that pertain to self employed applicants. These guidelines are in addition to the standard FHA loan requirements.

Would you like to see if you qualify for a FHA loan?

Click here to get matched with a mortgage lender

Understanding Mortgage Options for 1099 Employees

There are mortgage options for 1099 employees or independent contractors who do not own their own business. 1099 employees and independent contractors often face the same challenges as self employed business owners. They are entitled to many of the same tax deductions which makes it difficult to qualify for a mortgage.

Some of the programs mentioned earlier such as the bank statement loan or stated income loan are available to 1099 employees. The same holds true if you are an independent contractor.

The 1099 income you receive can be used to qualify based upon the income that you document on your tax returns. We are referring to your income after any business write offs. If you can document enough income, then conventional and FHA loans are available to you with more competitive interest rates.

Tips for Applying for a Mortgage as a Self Employed or 1099 Employee

When applying for a mortgage as self employed or 1099 independent contractor, it is important to prepare to give yourself the best chance to be approved, or to get the highest mortgage loan amount possible.

For the majority of the loan programs, the loan officer will ask for your bank statements. This includes your business and personal checking and savings accounts. You will be putting the current balance on the loan application but the loan officer will be looking at the average monthly deposits. Therefore, the first step in the process is to make sure you are depositing all of the cash earned into your bank accounts each month. If the loan officer cannot see that your money was deposited, they have no way to verify whether you earned the money at all.

Next, focus on your credit if you have a low credit score. Increasing your credit score will lower your down payment and improve the interest rate offered by the lender. You should check and monitor your scores well before completing the application.

Focus on your credit card debt and reduce your balances wherever possible. You should never exceed 30% of the credit limit at any point during the month.

Finally, refrain from any large purchases like buying a car or anything else that will result in a monthly payment on your credit report. Otherwise, the monthly payment will reduce the amount you may be approved for.

These steps will signal financial stability to the mortgage lender and will help with your approval or will increase the potential loan amount.

Best Self Employed Mortgage Lenders of 2024

We have included a list of the best mortgage lenders for self employed borrowers. These programs allow you to use 12 or 24 months worth of bank statements to document your income instead of tax returns. If bank statements are not available, then there are other programs which may be better suited for you.

We work with many self employed type of mortgage lenders, and would be happy to help you discover your options, so that you can be sure to find the best home loan.

1 – Dream Home Financing – Extensive experience and reputation for helping self-employed – Contact

2 – Acra Lending – Contact

3 – Angel Oak Mortgage Solutions – Contact

4 – Northstar Funding – Contact

5 – First National Bank – Contact

6 – Carrington Mortgage – Contact

Want to find out if you qualify for a bank statement loan? We can help match you with a lender who can help you see if you qualify.

Best Mortgage Lenders for 1099 Employees

There are many lenders that provide home loans for 1099 Employees. We work with several of these wholesale lenders, and can match you with a lender who helps customers in your area.

A few of the top lenders for 1099 employees are:

1 – Dream Home Financing – Contact

2 – Quicken Loans – Contact

3 – New American Funding – Contact

5 – PennyMac Loan Services – Contact

These are just a few of the most well known lenders offering FHA loans nationwide. As stated above, it is advised to see what terms local FHA lenders may offer you. We would be glad to help you discover your options.

Click here to get matched with a lender now.

Frequently Asked Questions

How do I apply for a self employed mortgage loan?

Depending on where you are located, we will connect with the best self employed mortgage lender, who will assist you through the application process. The most efficient way to be connected with the appropriate lender is to fill out this form.

If I am not ready to buy a home now, what can I do to be prepared in the future?

One of the best pieces of advice that we could give someone who is self employed is to do all that you can to get your finances and credit in order. The better your credit, and more organized your business and personal finances are, the more likely you are to be approved.

Can you be a first time home buyer and still qualify for a self employed mortgage?

All of the mortgage programs featured on this page offer options for first time home buyers who happen to be self employed.

Is down payment assistance available for the self employed?

It depends on the specific down payment assistance program. Some of these programs are intended for low income households, but most do not explicitly state that you can not be self employed. The best way to find out is to speak with the agency that offers the assistance. We can assist you in the process of looking up all the programs available in your area, and to find out if you are eligible.

What types of self employed professionals and business owners may obtain financing?

These loan programs are great for nearly all types of self employed professionals. Some examples are: accountants, attorneys, business owners, child care workers, contractors, dentists, entrepreneurs, freelance writers, graphic designers, hairstylists, home cleaners, marketing consultants, photographers, professional speakers, real estate agents, truck drivers, web developers, and many more other types of self employed people.

What is considered qualifying income for self-employed borrowers?

Conventional and FHA loans will only use your taxable income. If you write off a lot of business expenses, this income will not be used for your qualifying income. So if you make $7,000/month, and have $2,000/month in business expenses that can be written off, your taxable income is only $5,000/month.

Your qualifying income is important in factoring your debt-to-income ratios (DTI ratios). FHA and conventional lenders usually have a maximum 43%-56% DTI ratio. For bank statement loans, it will depend on the lender, but fortunately most will let you use your full income (all that is shown as deposits on your bank statements).

What income documentation will be required?

The exact documentation that will be required will be outlined on your loan approval (if you are approved). What is needed will also depend on the type of loan you apply for. FHA and conventional loans will likely require 1-2 years tax returns, and your 2 most recent pay stubs and bank statements. For bank statement programs, only your bank statements are needed (12-24 months depending on the exact requirements of the lender).

Regardless of the program, some mortgage lenders may want you to provide some of the following: a copy of your business license, a CPA letter, a P&L statement, and possibly at least one letter of reference from a client. The required documentation will depend on the lender you apply with, as well as the type of business you own.

If my business produces seasonal income, will this disqualify me?

If your income is seasonal or largely inconsistent, this may cause issues in qualifying for a FHA or conventional loan. However, bank statement programs take the average of 12 or 24 months worth of bank statements and average out the monthly income. Therefore, if your income is seasonal, you still may be able to get a mortgage.

Are there private mortgage lenders for self employed?

Private mortgage lenders can offer programs for self employed and many of them can be someone in your network. Even a friend or relative can be a private lender.

What are the qualifications for a mortgage as a 1099 employee?

Your lender will look at your financial stability by assessing how much cash you earn each month. It will be a requirement for you to have been earning in this capacity for at least two years. They will also have a minimum credit score and down payment requirement.

Are there specific documents required for mortgage applications as a 1099 employee?

You will be required to provide 12-24 months of bank statements, the sales contract if you are buying the home, and proof of homeowner’s insurance before closing. Be prepared for additional requirements from the underwriter after your loan application has been submitted.

What interest rates and terms can I expect from mortgage lenders for 1099 employees?

If you are applying for one of the creative mortgage programs, you can expect interest rates to be 1%-2% higher than conventional rates. You may also be required to pay points or origination fees. The loan terms available are 30 years, 15 years, and also adjustable rate terms.

Facts About These Mortgages

Relevant Statistics

Have a question that you don’t see here? We would love to hear from you!

Contact us with your questions