USDA Loan Requirements – USDA Mortgage Lenders

USDA loans are popular with borrowers that have lower credit scores, lower income, or no down payment. In fact, the USDA loan programs are intended for lower income individuals and families, and there are actually limits to how much money you can make.

Other names for USDA loans are “USDA rural development loans” and “rural housing loans”. All of these terms are talking about the thing. There are two different USDA programs, however. The USDA guaranteed loan, and the USDA direct loan. If you have really low income, you may want to look into a USDA direct loan. Most borrowers who get a USDA loan are financed through the USDA guaranteed loan though, which is the USDA loan program featured on this page and offered by most USDA lenders.

What attracts many to the USDA guaranteed loan is that there is no down payment required.

USDA Loan Features

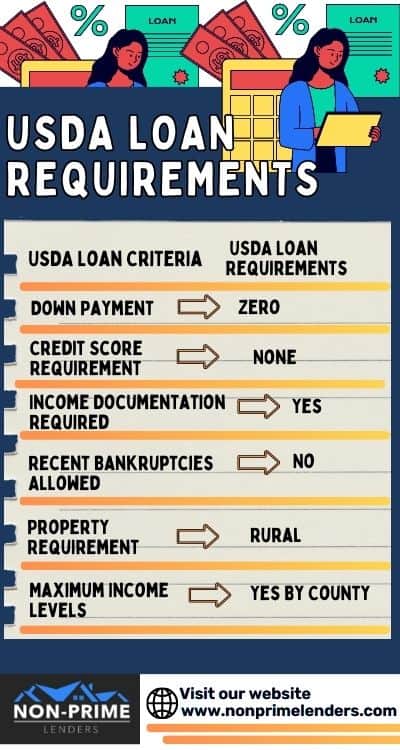

In this chart, you can see the basic features of the USDA home loan. This view at a glance will provide you with a summary of what is required.

| USDA Loan Criteria | USDA Loan Requirements |

| Down Payment | Zero |

| Credit Score Requirement | None |

| Income Documentation Required | Yes |

| Recent Bankruptcies Allowed | No |

| Property Requirement | Rural |

| Maximum Income Levels | Yes By County |

USDA Loan Requirements

Below are the various USDA loan requirements. To qualify for the USDA guaranteed loan program, you must meet all of the requirements related to credit, income, debt, employment, as well as those related to the property itself.

In this chapter we will review the following aspects of the USDA home loan:

- USDA credit requirements

- USDA income requirements

- USDA DTI limits

- USDA Property Requirements

USDA Loan Credit Requirements

There is no minimum credit score needed to get a USDA loan. However, lenders impose their own credit score minimums which may be higher. If your credit score is below a 620, but you have sufficient “compensating factors”, you may still be able to get a USDA loan. Your application will have to be manually reviewed in order to obtain an approval.

In addition to the credit score requirements, you must also satisfy other conditions related to your credit. This includes mandatory waiting periods after major credit events, such as a bankruptcy, foreclosure, or short sale (2 years in most cases).

Additionally, you must be able to show at least 3 trade-lines on your credit report, such as credit cards or auto loans. If you do not have sufficient trade-lines on your credit report, you may still qualify with alternative forms of credit, such as phone bill, utility payments, or even a gym membership.

USDA Loan Income Requirements

There are requirements related to your employment and income. First of all, you must not make too much money in order to be eligible. There are strict income limits set in place for every county in the USA. Generally, you can not make more than 115% of the average income for your county. You can view the USDA income limits for your county (and also see what deductions you may be eligible for) by using the income eligibility section of the USDA website.

In terms of employment, there aren’t any requirements for your job history, but just that you can show at least 2 years of stable income. You can be employed or self-employed, but your income must be deemed to be steady and reliable.

USDA DTI Limits (Debt-to-Income Ratios)

Another aspect of your income that is looked at is your debt-to-income ratios (DTI ratios). The DTI limits are broken down into both the front end ratio and the back end ratio.

Front-end ratio: The first ratio that is looked at, is your monthly mortgage payment compared to your monthly income. The maximum percentage that your mortgage payment can be compared to your monthly income is 29%. So if your household income is $4,000, your monthly mortgage payment can not be more than $1,160 (which is 29% of $4,000).

Back-end ratio: Your total monthly debts will also be looked at. This includes your mortgage payment and all other debts reported on your credit report that require a monthly payment, such as auto loans and credit card payments. The maximum percentage that your total monthly debt payments can be compared to your monthly income is 41%.

You may be able to qualify with higher DTI ratios with adequate “compensating factors”. If that is the case for you, then contact us to see if you are eligible.

USDA Loan Property Requirements

USDA loans are only available for certain types of properties, and in certain locations. The first step in finding a home for sale that is eligible for USDA financing, is to understand the location requirements. USDA loans are only available outside of cities and larger towns.

USDA loans are available in nearly 97% of the total land mass of the United States, but this excludes all cities and larger towns. Fortunately, areas just outside of cities and towns are eligible for USDA financing.

The best way to find out if a specific property or location is eligible, use the USDA property eligibility search on the USDA website. You can enter an exact address, or use the zoom function to look at entire areas to determine property location eligibility.

In addition to location restrictions, there are also guidelines related to the type of property you may purchase, as well as the general condition that the home must be in. USDA loans are only available for owner occupied properties. This means that you can not buy an investment property, or any sort of income-producing property (such as a farm).

The property condition requirements state that the home must be modest, meaning no extravagant or luxury homes. The home must also be in good condition, meaning you can not buy a home that is in need of extensive renovations.

Would you like some assistance in determining property eligibility, or see if you qualify for a USDA loan? Request a free consultation on our contact form.

USDA Minimum Credit Score

There is no minimum credit score required by the USDA. However, lenders will overlay their own minimum credit score requirements. We have lenders who are willing to work with much lower credit scores. They may also help guide you in how to improve your credit scores.

If you have higher credit scores, not only will your chances for approval be increased, but your interest rate will also be better. In this video, we will explain further.

How to Apply for a USDA Loan

Applying for a USDA loan is virtually the same as what you may encounter with a conventional or FHA loan. The first step is to find a lender who offers the program. If you have not found a lender, then contact us here and we can help you in all 50 states.

Next, you should be prepared for the following:

- Complete the loan application. This is required for a basic pre-approval letter

- Submit your pay stubs for the past 30 days

- Provide copies of your W2s and tax returns for the past 2 years

- Provide copies of your last two months bank statements

- Provide copies of your most recent investment or retirement account statements

Once you have completed the application and provided the documents referenced above, your loan officer will run your application through the automated underwriting system. If the system approves your loan, then the loan officer can provide you with a pre-approval letter so you can shop for a home.

If you have already found the home, your loan officer can also check to see whether the property you are interested in is also eligible for a USDA loan.

Is a USDA Loan Right for Me?

A USDA loan may be your best option to finance your new home. However, you really need to weigh all of your options before selling yourself on a USDA loan.

Home buyers often cite the zero down option as the primary reason why they are interested in an FHA loan. Another benefit that is often overlooked is the fact that there is no PMI like you may have with a conventional or FHA loan.

Remember that USDA loan have an income limit and the home must be located in a rural area. So, if you earn too much and the home you love is not rural, then you may want to consider an FHA loan. With FHA, you can still find down payment assistance. Read more about FHA loans.

Frequently Asked Questions

What are the qualifying compensating factors that allow exceptions to be made for loan approval?

If you do not meet certain requirements, such as those related to your credit score, or debt-to-income ratios, you may still qualify for a USDA loan if you have certain “compensating factors”. If your credit score is lower than a 640, but you have low debt-to-income ratios, money in savings, or a long time on the same job, you may still qualify. Also, if your debt-to-income ratios are higher, but you have good credit (660 or higher), you may still get approved.

If I have had a job change in the last 2 years, will this disqualify me?

There isn’t any requirement that you must be employed at the same job for 2 years. As long as you can prove steady, reliable income, a job change should not disqualify you.

What if I am newly employed, is it possible to get a USDA loan?

If you have less than 24 months of established job history, there is still a chance that you can get approved, especially if you were in school studying a related field to your current job. The only way to find out if you are eligible, is to apply and see if you are approved.

Do USDA loans require mortgage insurance?

USDA loans require that you pay what is known as a guarantee fee, which acts similarly to mortgage insurance. Fortunately, it is cheaper than the mortgage insurance premiums for FHA loans, or private mortgage insurance on conventional loans. Also, you can finance the costs of the upfront guarantee fee into your loan (so you do not have to pay it out of pocket at closing).

Can I get a USDA loan with a fixed rate?

Yes, in fact USDA loans are only available on a 30 year fixed rate mortgage. This provides you with the security of a fixed monthly payment that does not fluctuate or go up.

Can you get a USDA Loan with Bad Credit?

You can get a USDA loan with bad credit if you have compensating factors. These may include higher income, on time payments from a previous mortgage, or job stability.

Are there any other requirements that I should know about?

One miscellaneous requirement is that you must be a U.S. citizen in order to be eligible for a USDA loan.