The VA IRRRL, which stands for “Interest Rate Reduction Refinance Loan” provides qualified VA homeowners the change to quickly and easily refinance their mortgage into a lower rate and payment. The IRRRL is also known as the VA streamline refinance, which is the same program.

This program is exclusively available to eligible veterans and active duty members of the military, and offers an affordable and efficient opportunity to refinance.

The article provides information on VA IRRRL lenders, focusing on refinancing options for US homeowners. It covers eligibility requirements, application process, FAQs, program benefits, and considerations. Topics such as interest rates, lowering monthly payments, and comparing VA IRRRL with Cash-Out Refinance are also discussed.

Additionally, readers can learn about closing costs, credit scores, and tips for securing the best interest rate. The article aims to guide homeowners in making informed decisions about refinancing with a VA IRRRL.

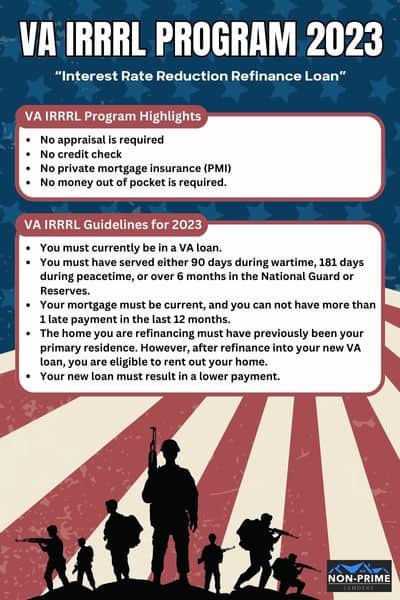

VA IRRRL Program Highlights

- No appraisal is required

- No credit check

- No private mortgage insurance (PMI) is required, saving you a lot of money overtime.

- You have the option to include all of the loan fees into your new loan amount, therefore no money out of pocket is required.

VA IRRRL Guidelines for 2024

Below are the standard loan requirements for the IRRRL program. Keep in mind, that whatever VA lender you use may have additional requirements that must be satisfied in order for your loan to be approved and closed.

- You must currently be in a VA loan, which means that you would have already provided your Certificate of Eligibility (COE). Therefore, it should not be expected to provide this again.

- You must have served either 90 days during wartime, 181 days during peacetime, or over 6 months in the National Guard or Reserves. As long as you were either active duty, or honorably discharged, you should be eligible.

- Your mortgage must be current, and you can not have more than 1 late payment in the last 12 months.

- The home you are refinancing must have previously been your primary residence (you must be able to verify that you have been occupying it, and not renting it out). However, after refinance into your new VA loan, you are eligible to rent out your home.

- Your new loan must result in a lower payment (you can not refinance into a higher rate and payment, unless you are switching from an adjustable rate mortgage into a fixed rate).

Am I eligible for an IRRRL?

The VA IRRRL (Interest Rate Reduction Refinancing Loan) program offers refinancing options for eligible homeowners. To determine if you qualify for an IRRRL, you need to meet specific eligibility requirements and assess your eligibility accurately.

Eligibility requirements for a VA IRRRL

To be eligible for a VA IRRRL, you must meet the following requirements:

- Currently have a VA-backed home loan

- Intent to refinance an existing VA loan to obtain a lower interest rate

- Occupied the property associated with the loan as your primary residence

- Be current on your mortgage payments with no more than one 30-day late payment in the past year

Determining if you qualify for an IRRRL

Aside from meeting the eligibility requirements, lenders will also consider other factors to determine your qualification for an IRRRL. These factors may include:

- Your credit history and credit score

- Your debt-to-income ratio

- The terms of your original VA loan

- Your ability to demonstrate a benefit from the refinance

It’s important to consult with VA-approved lenders who can evaluate your specific situation and guide you through the eligibility determination process.

How do I get an IRRRL?

Steps to apply for a VA IRRRL

If you’re considering a VA IRRRL, here are the steps involved in the application process:

- Gather your financial documents: Collect all necessary documents such as your mortgage statement, current loan details, and income verification.

- Contact a VA-approved lender: Reach out to a mortgage lender who participates in the VA IRRRL program. They will guide you through the application process.

- Complete a loan application: Fill out the required loan application forms provided by the lender. Be prepared to provide details about your current loan and financial situation.

- Submit necessary paperwork: Once your application is completed, submit all required documentation, including income statements, bank statements, and proof of homeowners insurance.

- Undergo credit and financial analysis: The lender will review your credit score and financial information to determine your eligibility and assess your ability to repay the loan.

- Review and sign the loan agreement: Carefully review the terms and conditions of the new loan, including interest rates, fees, and repayment terms. If you agree to the terms, sign the loan agreement.

- Wait for loan approval: After submitting your application, the lender will review and process it. If approved, you will receive an approval letter outlining the terms of the refinanced loan.

- Close the loan: Once the loan is approved, you’ll need to attend the closing process and sign the necessary paperwork to finalize the VA IRRRL.

Documentation needed for an IRRRL application

To complete your IRRRL application, you will typically need the following documents:

- Mortgage statement: A copy of your current mortgage statement to provide details about your existing loan.

- Proof of occupancy: Provide documentation that shows the property is your primary residence, such as a utility bill or driver’s license.

- Income verification: Recent pay stubs or income statements to demonstrate your ability to repay the loan.

- Bank statements: Statements from your bank accounts to verify your financial stability and assets.

- Proof of insurance: Provide evidence of homeowners insurance coverage for the property being refinanced.

- Identification documents: Valid identification documents, such as a driver’s license, passport, or social security card.

Remember, additional documentation may be requested by the lender during the application process. It’s essential to work closely with your chosen lender to ensure you have all the necessary paperwork and information ready.

VA Approved IRRRL Lenders

You can use any VA approved lender to utilize the IRRRL program. The list below are considered to be among the best lenders offering this loan.

Please note: We are not affiliated with all mortgage lenders featured on our website. We include some of the best lenders for various programs. If you would like some assistance getting matched with an excellent VA lender in your location, please fill out this form, and we will do our best to match you with an IRRRL lender in your location. Keep in mind, that you do NOT have to use the VA lender you you previously financed your home through.

Understanding the Benefits of an IRRRL

When considering a VA IRRRL, it’s important to understand the benefits it offers:

Streamlined Process

Unlike traditional refinancing, a VA IRRRL requires less documentation and a simplified approval process.

Lower Interest Rates

A VA IRRRL often comes with lower interest rates, helping homeowners save money over the long term.

Reduced Monthly Payments

By refinancing through a VA IRRRL, homeowners can potentially lower their monthly mortgage payments.

No Out-of-Pocket Expenses

With a VA IRRRL, borrowers can roll all closing costs and fees into the new loan, reducing the need for upfront payments.

Flexibility with Repayment Terms

VA IRRRLs offer flexibility in choosing the repayment terms, allowing homeowners to find an option that suits their financial goals.

No Required Home Appraisal

Unlike some other refinancing options, a VA IRRRL generally does not require a new home appraisal, saving time and money in the process.

Possibility of Cash-Out

Under certain circumstances, homeowners may be eligible to convert a portion of their home equity into cash with a VA IRRRL.

Considering these benefits, homeowners can make informed decisions about whether a VA IRRRL is the right choice for their refinancing needs.

Pros and cons of VA IRRRL

Pros:

-

- Reduced paperwork and faster approval process

- Potential for lower interest rates

- Possible reduction in monthly mortgage payments

- No requirement for a new appraisal or credit report

Cons:

-

- May not be suitable for homeowners planning to stay in their current home for a short period

- Closing costs associated with the IRRRL may be paid upfront or rolled into the loan balance

- Limitations on accessing cash from home equity

Learning about VA IRRRL Closing Costs

Overview of closing costs associated with VA IRRRL

When considering a VA IRRRL (Interest Rate Reduction Refinance Loan), it’s essential to understand the closing costs involved. Closing costs refer to the fees and expenses associated with finalizing your refinancing. These costs may include loan origination fees, appraisal fees, credit report fees, title examination fees, and other necessary expenses. It’s crucial to review the lender’s loan estimate or closing cost disclosure to have a clear understanding of the specific costs involved in your VA IRRRL.

How to minimize closing costs when refinancing with an IRRRL

While closing costs are an inevitable part of refinancing, there are strategies to minimize these expenses when opting for a VA IRRRL. Here are a few tips to consider:

- Compare lenders: Shop around and obtain quotes from various VA IRRRL lenders to compare their closing cost structures. This allows you to choose a lender with more competitive fees and potentially reduce your overall closing costs.

- Waive the appraisal: Since the VA IRRRL program doesn’t require a new appraisal in most cases, you may have the option to waive it. This can save you money on the appraisal fee.

- Negotiate with the lender: Some lenders may be willing to negotiate closing costs as part of their competitive offerings. Don’t hesitate to discuss these costs and explore potential concessions or reductions with your lender.

- Roll costs into the loan: If you prefer to minimize upfront expenses, you can consider rolling the closing costs into your VA IRRRL loan. This allows you to finance the costs over the life of the loan, but it’s important to weigh the potential long-term impact on your repayment.

Remember, while minimizing closing costs is beneficial, it’s also crucial to assess the overall financial impact of refinancing, including the potential monthly savings and loan terms. By carefully reviewing your options and working with reputable VA IRRRL lenders, you can make informed decisions to ensure a smooth refinancing process.

Exploring VA IRRRL Interest Rates

Understanding the Role of Interest Rates in VA IRRRL

When considering a VA IRRRL (Interest Rate Reduction Refinance Loan), it’s important to understand the significance of interest rates. The interest rate on your IRRRL directly impacts your monthly mortgage payment amount and determines how much you’ll pay over the life of the loan.

With a lower interest rate, you can potentially lower your monthly payments, allowing for increased savings. Additionally, a reduced interest rate can result in overall savings on your mortgage by reducing the total amount of interest paid over time.

Tips for Securing the Best Interest Rate on an IRRRL

Securing the best interest rate on your VA IRRRL can help you maximize the potential benefits of refinancing. Here are some tips to help you navigate the process:

- Monitor interest rate trends: Keep an eye on interest rate fluctuations, as this can help you identify the ideal time to refinance with a more favorable rate.

- Improve your credit score: A higher credit score demonstrates your creditworthiness to lenders and can lead to better interest rate offers. Take steps to improve your credit by paying bills on time, reducing debt, and disputing any errors on your credit report.

- Shop around for lenders: Different lenders may offer varying interest rates and terms. Take the time to compare offers from multiple VA-approved lenders to ensure you secure the most competitive rate.

- Consider closing costs: While interest rates are important, it’s crucial to also consider the associated closing costs. Evaluate and compare the overall cost of refinancing, including fees and expenses, to determine the best long-term financial choice.

- Work with a mortgage professional: An experienced mortgage professional can guide you through the refinancing process and help you find the best interest rate options for your specific circumstances. They can provide personalized advice and assist in selecting the loan terms that align with your goals.

By understanding the role of interest rates in your VA IRRRL and following these tips, you can increase your chances of securing the best interest rate and optimizing the benefits of refinancing.

Lowering Monthly Payments with a VA IRRRL

Lowering Monthly Payments with a VA IRRRL focuses on how homeowners can reduce their monthly mortgage payments through the VA IRRRL program. By refinancing their existing VA loan, borrowers can take advantage of lower interest rates and potentially save money each month. This section explores the process and factors to consider when evaluating the potential savings of a VA IRRRL.

How a VA IRRRL can reduce your monthly mortgage payments

Refinancing with a VA IRRRL offers homeowners the opportunity to lower their monthly mortgage payments. By securing a lower interest rate, borrowers can significantly reduce their mortgage expenses. Additionally, the streamlined and simplified nature of the VA IRRRL program makes the refinancing process hassle-free. This sub-section provides insights into how the VA IRRRL program works and helps homeowners understand the potential for monthly payment reduction.

Factors to consider when evaluating potential savings

When considering a VA IRRRL for lowering monthly payments, several factors should be taken into account. This includes the remaining term of the loan, closing costs, and the length of time the homeowner plans to stay in the property. Assessing these factors allows borrowers to determine if the potential savings justify the refinancing effort. This sub-section provides a comprehensive overview of the key factors to consider when evaluating the potential savings of a VA IRRRL.

The Benefits of Refinancing with a VA IRRRL

Refinancing your mortgage with a VA IRRRL loan program offers several advantages that can benefit homeowners in the United States. Let’s explore these benefits in detail:

Exploring the advantages of a VA IRRRL loan program

When considering a VA IRRRL loan program, it’s essential to understand the advantages it provides. Here are some key benefits:

- Simplified process: VA IRRRL refinancing offers a streamlined and straightforward process compared to other refinancing options. This means less paperwork and quicker approval times.

- Lower interest rates: One of the main advantages of VA IRRRL is the potential for significantly reducing your interest rate. This can result in substantial long-term savings.

- Reduced monthly payments: By securing a lower interest rate through a VA IRRRL, homeowners can enjoy decreased monthly mortgage payments, which can free up funds for other essential expenses.

- No appraisal or credit check requirements: Unlike conventional refinancing options, VA IRRRL typically does not require a new appraisal or a complete credit report. This simplifies the process and reduces associated costs.

How an IRRRL can provide financial flexibility for homeowners

In addition to the advantages mentioned above, a VA IRRRL loan program can provide homeowners with increased financial flexibility. Here’s how:

- Cash-out option: With a VA IRRRL, homeowners have the opportunity to convert their home equity into cash. This allows them to access funds for various purposes, such as home improvements, debt consolidation, or other financial needs.

- Debt reduction: By refinancing with a VA IRRRL, homeowners can consolidate high-interest debts into a single, more manageable monthly payment. This can help in reducing overall debt and improving their financial well-being.

- Long-term savings: With lower interest rates and reduced monthly payments, homeowners can experience substantial long-term savings. This frees up funds for savings, investments, or other financial goals.

- Improved cash flow: Lower monthly mortgage payments through a VA IRRRL allow homeowners to have increased cash flow, providing financial flexibility for emergencies, education, or other essential expenses.

Overall, refinancing with a VA IRRRL loan program offers homeowners in the United States the advantages of streamlined processes, potential cost savings, increased financial flexibility, and improved financial well-being. It’s crucial to evaluate individual circumstances and consult with a qualified VA-approved lender to determine if a VA IRRRL is the right choice.

Exploring the limitations and considerations for streamline refinancing

While VA IRRRL offers many benefits, it’s important to consider the limitations and factors associated with streamline refinancing. Here are some key considerations:

- Eligibility requirements: While the VA IRRRL program has relaxed eligibility criteria, borrowers must still meet certain requirements, such as having an existing VA loan and being current on mortgage payments.

- Funding fee: Streamline refinancing typically involves a funding fee, which may vary based on factors like the borrower’s military service and down payment history. It’s important to factor in this cost when evaluating the overall benefits of an IRRRL.

- Interest rates: While VA IRRRL generally offers lower interest rates, it’s crucial to compare rates and determine if refinancing will result in significant savings over the loan’s duration.

- Loan limits: Streamline refinancing is subject to certain loan limits imposed by the VA. Borrowers should consider these limits while assessing their refinancing options.

- Available options: Streamline refinancing only applies to existing VA loans and cannot be used to convert a non-VA loan into a VA loan. Borrowers must consider if this aligns with their specific financial goals.

While streamline refinancing with VA IRRRL provides a simplified and convenient way to refinance, it is essential to carefully evaluate the limitations and considerations mentioned above to make an informed decision regarding your refinancing needs.

VA IRRRL Frequently Asked Questions

Will I have to pay the VA funding fee again?

In most cases, you will have the pay the VA funding fee for any new loan issued. For most borrowers, this is 0.5% of the loan amount. The only exception is for qualifying disabled veterans, or a surviving spouse of a member of the military who passed away during service. In these instances, no funding fee is required. For everyone else, the funding fee is slightly higher for second time borrowers who are not making a down payment. You can learn more about the VA funding fee, to make sure you understand clearly how this works.

Can I cash out refinance or take any equity out?

No, you may not take any cash out using the VA IRRRL. You would need to look into the VA cash out refinance if you are needing to tap into your home equity.

Can I refinance from a different type of loan using this program?

No, you can not refinance from another type of mortgage (such as a conventional or FHA loan). However, you may be able to refinance from any other type of home loan into the VA cash out refinance program.

Is it allowed to switch the loan amortization, such as from a 15 year fixed to a 30 year fixed?

Yes, you can switch from a 30 year fixed into a 15 year fixed, or vice versa.

What are some of the most significant pros and cons of the VA IRRRL program?

The pros far outweigh the cons. The general ease and affordability are major advantages. The only major disadvantages are that you can not take out cash, and you will have to pay the VA funding fee again. Other than that, this is a truly special refinance loan program.

The Bottom Line

In conclusion, VA IRRRL offers both pros and cons for homeowners considering refinancing options. It’s essential to carefully evaluate whether this program aligns with your specific financial goals and circumstances.