Piggyback Mortgage Loans

Some people may be surprised that piggyback loans still exist in 2024. Not only do they exist, but there are several mortgage lenders that are offering these types of loans.

Piggyback loans are a popular alternative for homebuyers in the US who have saved very little for a or for those who are looking to avoid PMI.

These second mortgages allow borrowers to qualify for a primary mortgage without paying for private mortgage insurance. While they were more common in the early to mid-2000s, piggyback loans offer benefits like lower interest rates and customizable loan structures.

How a piggyback mortgage works, is a home buyer (or someone who needs to refinance) will borrow the first 80% in the exact same manner that you would with a traditional mortgage. For the remaining amount (whether that be 5%, 10%, or 15%), a second mortgage will be “piggybacked” with the first mortgage.

Types of Piggyback Mortgage Program

Below are the main types of piggyback loan programs that lenders offer. There used to be a 80/20 program (80% as a first mortgage, and 20% as a second mortgage, which meant you could borrow 100% of the loan amount), but unfortunately, the 80/20 program no longer exists.

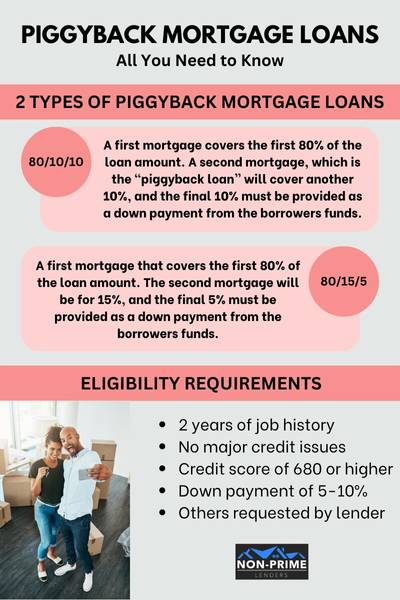

- 80/10/10 Piggyback Loan – This is the most common type of piggyback loan. How a 80/10/10 loan works is a first mortgage covers the first 80% of the loan amount. A second mortgage, which is the “piggyback loan” will cover another 10%, and the final 10% must be provided as a down payment from the borrowers funds.

- 80/15/5 Piggyback Loan – Another piggyback loan option is the 80/15/15 program. How this loan works, is there is a first mortgage that covers the first 80% of the loan amount. The second mortgage will be for 15%, and the final 5% must be provided as a down payment from the borrower’s funds.

Some lenders may also offer you a 80/5/15 piggyback loan option, but this is not a highly sought after program, so there are not many lenders advertising this program.

Click here to be connected with a piggyback mortgage lender

Piggyback Loan Requirements

The requirements and loan terms vary from one lender to the next. However, most lenders offering this type of program share several of the same guidelines. Keep in mind, the requirements featured below are not concrete with any specific lender, but you should expect the following:

- A borrower will generally need to meet all of the same guidelines set forth for a conventional loan. This includes at least 2 years of satisfactory job history, no major credit issues, and some lenders may impose reserve requirements (a certain amount of liquid savings).

- Expect to need a 620 or higher credit score. To qualify for a piggyback loan, you need to have a satisfactory credit history and a good credit score. Additionally, you must demonstrate a consistent and reliable income source, with a low debt-to-income ratio. Meeting these financial eligibility criteria increases your chances of securing a piggyback mortgage.

- You will need to provide a down payment. The amount required will depend on what piggyback loan program you apply for. On a 80/10/10 program, you should expect to need to put 10% down. On a 80/15/5 program, you will need to put 5% down.

Would you like to find out if you qualify for a piggyback loan? You can receive a free pre-approval and rate quote from one of our participating mortgage lenders offering these types of loans.

Piggyback Mortgage Lenders

All of the mortgage lenders featured below offer piggyback loans, as well as traditional mortgages, such as FHA, USDA, and conventional loans. We recommend speaking with a knowledgeable loan specialist at one of these companies who can help you make an informed decision.

1 – Alpine Banker – Contact

2 – Bluewater Mortgage – Contact

3 – Northstar Funding – Contact

4 – Arcus Lending – Contact

5 – First Castle FCU – Contact

6 – Wholesale Capital Corporation – Contact

7 – Citywide Home Loans – Contact

Would you like some assistance finding a piggyback mortgage lender? We would be happy to help you determine which mortgage lender may offer you the best loan based on your location. Simply fill out this form, and we will connect you with a lender.

Pros and Cons of Piggyback Loans

There are some clear advantages and disadvantages of piggyback loans.

Advantages:

- Avoid Mortgage Insurance – One of the biggest advantages of a piggyback loan is that mortgage insurance (PMI) may be avoided, which can potentially save a borrower a significant amount of money over the life of the loan. Any mortgage that exceeds an 80% LTV requires mortgage insurance, which is one of the main reasons that a borrower would finance a home with a piggyback loan.

- Smaller Down Payment – Another advantage is for a borrower who wants to purchase a home that would require them to make a larger down payment (such as would be the case with a more expensive home that does not meet the conforming or FHA loan limits, and therefore would need to be a jumbo loan, unless broken into 2 loans).

Disadvantages:

- Additional Closing Costs – The main disadvantage to consider is that a second mortgage, which will be a home equity loan, will incur additional closing costs.

- May Need to Apply Twice – Unless you are using the same lender for both loans, you may need to apply for the two mortgages separately.

- Interest Only Second Mortgage – Home equity loans are usually interest only loans, which means you are not paying down any of the principle on the second mortgage. This could potentially cause problems in the future if you want to refinance, and you still owe the same amount of money on the second mortgage.

Risks and Considerations of Piggyback Loans

Higher Overall Costs

While piggyback loans offer benefits such as low down payments and avoidance of mortgage insurance, it’s important to understand that they generally come with higher overall costs. These costs can include additional interest payments on the second mortgage, origination fees, and closing costs. It’s crucial to carefully consider and compare the total costs associated with a piggyback loan before making a decision.

Potential Foreclosure Risks

Another aspect to consider is the potential foreclosure risks involved with piggyback loans. In the event of financial hardships or difficulties making payments, having multiple mortgage loans can increase the risk of foreclosure. It’s essential to have a comprehensive understanding of the financial obligations and the potential risks of defaulting on any of the loans.

Impact on Refinancing and Selling the Home

Additionally, piggyback loans can have an impact on future refinancing or selling of the home. Refinancing the primary mortgage or selling the property may become more complicated due to the presence of the second mortgage. Some lenders may have specific requirements or restrictions on refinancing or selling a home with a piggyback loan. It’s important to thoroughly research and understand these potential limitations before opting for a piggyback loan.

Tips for Qualifying and Applying for a Piggyback Loan

When considering a piggyback loan, you should understand the qualifying and application process. Here are some valuable tips to help you navigate through the process successfully:

Improving Credit Score and Debt-to-Income Ratio

Prior to applying for a piggyback loan, take steps to improve your credit score and reduce your debt-to-income ratio. This can be achieved by paying off existing debts, making timely bill payments, and avoiding any new substantial debts. Lenders typically prefer borrowers with a higher credit score and a lower debt-to-income ratio, as it demonstrates financial responsibility.

Finding a Piggyback Loan Lender

One of the first steps in securing a piggyback loan is finding the right lender. Look for lenders with experience in piggyback loans and who are willing to work with borrowers with lower down payments. It’s essential to compare different lenders and their terms, including interest rates, fees, and closing costs. Working with a reputable lender who understands your specific financial situation can make the process smoother.

Understanding Loan Terms and Documentation

Before finalizing your piggyback loan application, thoroughly review and understand the loan terms and documentation. This includes the repayment schedule, interest rates, penalties for early repayment, and any additional fees. Clearly understanding these terms can help you make an informed decision and avoid any surprises later on. Additionally, gather all the necessary documentation requested by the lender, such as income statements, tax returns, and bank statements, to expedite the application process.

In conclusion, qualifying and applying for a piggyback loan involves taking proactive steps to improve your credit score and reduce your debt-to-income ratio. Find a reliable lender who specializes in piggyback loans and to fully comprehend the loan terms and required documentation. Following these tips will increase your chances of qualifying for a piggyback loan and successfully securing the additional funds needed for your home purchase.

Case Study: Successful Piggyback Loan Scenarios

Real-life success stories showcase the benefits and potential of piggyback loans. These examples demonstrate how borrowers with low down payment savings could leverage this financing option to achieve their homeownership goals. In some cases, individuals who initially struggled to qualify for a traditional mortgage found success with a piggyback loan, allowing them to secure their dream home.

- Case Study 1: A first-time homebuyer with limited savings and a lower credit score utilized a piggyback loan to avoid PMI and obtain favorable interest rates. The combination of a smaller down payment and a second mortgage helped this borrower qualify for a primary mortgage and achieve homeownership.

- Case Study 2: A couple looking to upgrade to a larger home faced challenges with their previous home’s sale, resulting in insufficient funds for a sizable down payment. By utilizing a piggyback loan, they were able to bridge the financial gap and secure their new property while avoiding PMI.

- Case Study 3: A self-employed individual with fluctuating income struggled to meet traditional mortgage requirements. Through a piggyback loan structure, they were able to present a stronger financial profile, showcasing their ability to handle multiple mortgage payments effectively.

Frequently Asked Questions

Do I have to get separate appraisals for both loans?

No, you should be able to use the same appraisal for both loans.

If I am purchasing a condo, will there any condo questionnaires for the second mortgage?

No, most piggyback lenders will not require a condo questionnaire for the second mortgage.

How much higher is the interest rate usually on a second mortgage?

Usually the interest rate on a second mortgage is 2% higher than on a prime mortgage. This still may be considerably cheaper than what you would be paying on mortgage insurance, so it is just a matter of scrutinizing the numbers to see what is more economical for you.

What is the maximum loan amount available with a piggyback loan?

It depends on the lender, but some mortgage lenders will even offer piggyback jumbo loans. If you contact us, and let us know your location, and desired loan size, we will do our best to direct you to the best lender for your particular needs.

Can a piggyback loan help avoid needing a jumbo loan ?

In some cases, you may be able to keep your first mortgage below the conforming loan limit. The loan limits vary from one county to the next, so you will want to look at what the loan limits are in the location of the property you wish to finance. There is a certain possibility that a piggyback loan will help you avoid having your loan amount go into jumbo mortgage status.

How does a FHA loan compare to a piggyback loan?

If you do not have much in savings, or if your credit is not excellent, you may want to consider an FHA loan. Not only is the down payment as low as 3.5%, but you also may then be entitled to an FHA streamline refinance loan in the future. The downside is that all FHA loans require that you pay mortgage insurance. We recommend that you speak with a mortgage expert who can help clarify your options, and help you understand what type of loan may provide you with the best terms.

How do I apply for a piggyback loan?

We recommend speaking with a loan representative at any of the aforementioned lenders who are all highly reputable. If you would like some assistance getting matched with a lender, please contact us, we would be glad to help.