Private Money Lenders

Private money lenders offer mortgages for the purposes of buying or rehabilitating real estate properties. They are non-traditional lenders who have the ability to provide financing without requiring the typical documentation and can close quickly.

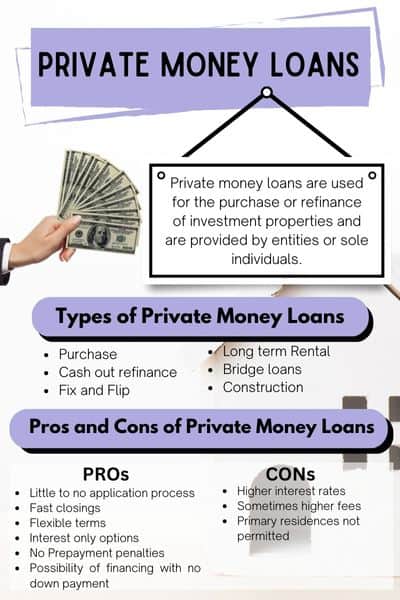

What are Private Money Loans?

Private money loans are used for the purchase or refinance of investment properties and are provided by entities or sole individuals.

Private money lenders are often people who you know with the desire to invest or earn interest in your real estate project. They also can be a small lender that is not a traditional bank.

The terms for private money loans are negotiable and have a wide range depending upon the nature of the investment and the lender or individual who you are dealing with.

Click to Speak With Someone About a Private Money Loan

| Loan Amounts | $30k – $5 Million |

| Interest Rates | 7% – 15% |

| Points | 1-5 |

| Prepayment Penalties | None |

| Down Payment | 0-20% |

| Loan Terms | 1 month – 2 years |

*private money lenders terms chart

Private Money vs Hard Money

There is a distinct difference between private money and hard money. In some instances, the terms offered between both can be similar.

With private money, you are often borrowing from a friend or a trusted individual. You may negotiate the terms and there will not be a specific lending guideline that you need to meet. Often there is no credit or income check and the money is loaned based upon trust and experience.

With hard money, you are dealing with a lender whose purpose is to lend money for investment projects. They will have set terms that you would need to abide by and may even check your credit scores. You can expect a hard money lender to also place a lien on the property which is something that likely will not happen with a private money lender who you have a relationship with.

Both private money and hard money allow for the opportunity to close quickly with little to no paperwork. For short term real estate projects, these options are optimal but when you are ready to convert to a long term rental loan, then it is time for a traditional lender with better terms for optimal cash flow. Read [How to Close Your Loan Fast]

Types of Private Money Loans

Private money loans are typically used for the following purposes:

Purchase – You can use a private money lender to provide financing for the purpose of purchasing an investment property, or a primary residence if the terms make sense.

Cash Out Refinance – If you already own property but you need to cash out equity, a private money lender is a great way to accomplish this quickly. They usually do not have maximum LTV requirements and may also accept being in second lien position if you already have a first mortgage.

Fix & Flip – The most popular reason to use a private money lender is for fix and flip opportunities. You purchase the property, rehab or update it, then sell it a few months later. In less than one year, you can make a nice profit.

Long term rental– With long term rentals, you want to have a low interest rate to maximize cash flows. If you are able to negotiate good terms with a private money lender, this would be a viable option.

Bridge Loans – Private money lenders can help with you need a bridge loan. This is usually a temporary situation to help get you through a period of time when you need to fill a gap with funding. Often times it is when you need the down payment to purchase another property while waiting for another sale to close.

Construction – If you are looking to build, private money can be an excellent way to finance the project. With fewer restrictions than a typical construction lender, this may be the best way to go. If you have experience with real estate construction projects, it will be easier to source private money funding.

How to Qualify for a Private Money Loan

Qualifying for a private money loan is much simpler and easier than a traditional mortgage. Lenders are not going to ask for income documentation and may not check your credit.

What is most important is the investment or real estate opportunity where the funds will be used. The lender is essentially investing in that deal with you when they loan you the money.

Be prepared to provide a detailed explanation of the deal and your plan to turn a profit. Having a history of successful real estate transactions will help in making the lender feel confident in approving your loan.

Pros and Cons of Private Money Mortgages

There are pros and cons of using private money to finance your real estate opportunity.

Pros

-

- Little to no application process

- Fast closings

- Flexible terms

- Interest only options

- No Prepayment penalties

- Possibility of financing with no down payment

Cons

-

- Higher interest rates

- Sometimes higher fees

- Primary residences not permitted

Private Money Lenders

These are some popular options when it comes to private money lenders. However, your specific scenario may require a particular lender. Complete this short contact form and we will help identify the best lender for you.

- Friends and Relatives

- Lightstream

- Best Egg

- Upstart

- LendingClub

National Private Money Lenders

Although most private money lenders are smaller in size, there are a handful of national private money lenders who are funding bridge and investment projects throughout the United States.

National private money lenders will often have less flexible guidelines and may also have higher credit score standards. Meanwhile, they may fund a wider array of property types and have the support system to also offer construction loans.

A few of the national private money lenders are listed below. However, we recommend contacting us about your needs first so we can pair you with a lender that fits best.

- National Private Lending

- We Lend LLC

- Stratton Equities

Small Hard Money Lenders

Small hard money lenders may lend in just one state or area within a particular state. When working with a small hard money lender, you can often get funded in a very short amount of time with fewer loan requirements.

The smaller lenders may be more choosy when it comes to approving the loan or property and their liquidity may be limited. This means they be making strategic decisions on which opportunities they prefer to finance. They feel more comfortable with loans that are for short term bridge and quick flip scenarios.

Private Money Lenders with No Credit Check

Many private money lenders do not check credit and have no minimum credit score requirements. This is good news for anyone who needs to get funded quickly but may have concern about having bad credit.

The larger national private money lenders may check credit, but the small private or hard money lenders will not use credit as a basis for approving your private money loan.

Private Money Lenders – FAQ

Do private money lenders need to be licensed?

Private money lenders do not have to be licensed and anyone can be a private lender.

Are private lenders safe?

Private lenders are safe but like anything else, you need to do your research. If needed, hire an attorney to draw up a contract between yourself and the lender.

Do private lenders do credit checks?

Most private lenders are not checking credit. However, some of the larger lenders who lend nationally may have credit score requirements.