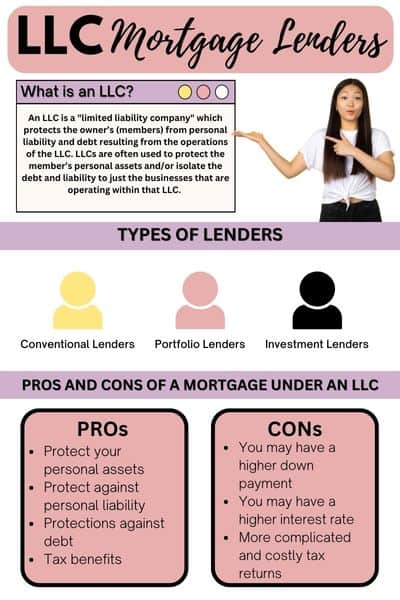

Buying a home under an LLC can provide various tax advantages and also personal protection from liability and law suits. There are LLC mortgage lenders who can help finance a property under your LLC with flexible terms.

What is an LLC?

An “LLC Is a limited liability” company which protects the owner’s (members) from personal liability and debt resulting from the operations of the LLC. LLCs are often used to protect the member’s personal assets and/or isolate the debt and liability to just the businesses that are operating within that LLC. Many investors will have a different LLC for each property.

Benefits of Buying a Home Under an LLC

When you purchase a home under an LLC, you create a shield protecting you from liability or debt resulting from the operations of that home. You also can operate the home as a unique business and enjoy various tax benefits associated with its operation.

Many investors will create a new LLC for each home they purchase. This means you are protecting your other investment properties from any liability that may occur at another. As an example, you could have someone slip and fall at a home that you own. They take you to court and sue for negligence. The most you can lose is any assets owned by that particular LLC. If you had all of your properties under the same LLC, then you would expose all of them within that law suit.

LLC Mortgage Lenders

When applying for a mortgage to finance a home or property that will be owned by an LLC, you will be limited to the types of lenders and mortgages that will be available to you.

Most loan programs do not allow the property to be held in the name of an LLC. Especially if that property will be your primary residence.

Conventional Lenders – Lenders who offer conventional loans only will not allow the loan to be closed with an LLC having ownership. What some individuals do is transfer ownership to the LLC after closing. Keep in mind, this may put you in default from a loan perspective.

Portfolio Lenders – There are some portfolio lenders who are willing to finance both a primary residence and also an investment property with an LLC as the owner. What you can expect is a larger down payment and a higher interest rate than a conventional loan. Both the down payment and interest rate will be determined by your credit scores.

Investment Lenders – When financing an investment property, the better investment lenders will actually prefer that you purchase the property under an LLC. Meanwhile, many local banks will not offer this as an option. Serious investment lenders also will not ask for tax returns and income documentation. The loan approval will be based upon your credit scores and potential cash flow of the property. Read [DSCR Lenders]

Click to speak with someone about your options.

Pros and Cons of a Mortgage Under an LLC

There are various pros and cons of buying and owning a home under an LLC. These are just a few examples and we recommend having a conversation with us to help you to decide whether an LLC mortgage lender is right for you.

Pros

-

- Protect your personal assets

- Protect against personal liability

- Protections against debt

- Tax benefits

Cons

-

- You may have a higher down payment

- You may have a higher interest rate

- More complicated and costly tax returns

Are you Personally Liable When Buying a Home Under an LLC?

When you buy and finance a home under an LLC, the lender will require you to be personally liable for the repayment of the mortgage.

Does an LLC affect getting a mortgage?

Putting a home under an LLC does affect getting a mortgage because conventional and government mortgage guidelines do not permit purchases under an LLC.

What Others are Saying About Buying a Property Under an LLC

Eric Jeanette – “When you purchase a property under an LLC, it offers protections from personal legal liability and limits the exposure to the properties within the LLC.”

Stessa.com – “Income and losses in an LLC are passed through directly to the owners, who then pay tax based on the individual tax bracket they are in.”

Avail.co – “Creating an LLC allows you to open up a business account, which helps keep all your rental property-related expenses and income separate from your personal income.”